Building a digital banking app like Mashreq NEOBiz in the UAE usually costs somewhere between $150,000 and $600,000 for a serious, production-ready product, depending on features, compliance scope, and where your team sits geographically.

This is not a basic wallet or a simple bill payment tool, but a full banking channel that must satisfy regulators, auditors, and demanding SME users.

Right now, this topic matters because SME banking in the GCC is moving online fast.

According to Statista:

- Digital banks in the UAE are expected to earn about US$3.02 billion in net interest income in 2025.

- This net interest income is expected to grow by about 4.49% per year from 2025 to 2030 and reach around US$3.76 billion by 2030.

- On a global level, China is expected to earn the most net interest income from digital banks, at about US$497.8 billion in 2025.

- In the UAE, more people are using digital banks because they like the ease, speed, and 24/7 access these online services offer compared to traditional bank branches.

Founders, CFOs, and business owners in the UAE want to open accounts, move money, and track cash flow from their phones without visiting branches or pushing paper forms.

At the same time, regulators in the region expect tighter controls, stronger KYC, and better reporting from any digital financial product.

If you are planning your own NEOBiz-style app, you are probably asking three questions:

- How much will this cost?

- Where is the money actually going?

Key Takeaways (Facts that Matter)

- Building a digital banking app like Mashreq NEOBiz in the UAE usually costs $150,000 to $600,000, depending on features, compliance, and security layers.

- UAE digital banks are expected to generate US$3.02 billion in net interest income in 2025.

- This revenue is projected to grow to US$3.76 billion by 2030, at a CAGR of 4.49%.

- China leads globally with an estimated US$497.8 billion in digital banking net interest income for 2025.

- SMEs in the UAE now prefer digital banking due to 24/7 access, fast onboarding, instant transfers, and zero branch visits.

- Regulators demand stronger KYC, AML, compliance, and audit-ready reporting for digital banking platforms.

(Source: Statista Digital Banking Report 2025)

The takeaway: Digital banking is booming—but building a compliant, secure system requires precise planning.

Overview of Mashreq NEOBiz-Style Digital Banking App

Mashreq NEOBiz targets SMEs, startups, and entrepreneurs

Mashreq NEOBiz targets SMEs, startups, and entrepreneurs who want to handle banking from their devices without visiting physical branches. The experience is built around smoother onboarding, quicker account opening, and tools that help business users handle daily cash flow.

Typical Feature Set You Compete With

A digital banking app that wants to compete with Mashreq NEOBiz usually needs a strong set of features.

- Digital business account opening with KYC and document upload

- Users can start the process from their phone or computer.

- They upload trade licenses, ID documents, and company papers as images or PDFs.

- KYC checks happen in the background, so the bank can verify identity and comply with regulations without asking for physical visits.

- Multi-currency accounts and local or cross-border transfers

- Businesses can hold money in different currencies, not just one.

- They can pay suppliers, staff, or partners inside the UAE and in other countries.

- This is useful for SMEs that import, export, or work with international clients.

- Clear dashboards for balances, cash flow, and transactions

- The home screen shows total balances and recent activity in a simple view.

- Users can quickly see money coming in and going out over a period.

- Easy filters and search options make it faster to find a specific payment, invoice, or date.

- Bulk payments, scheduled transfers, and vendor / payee management

- Instead of sending one payment at a time, businesses can upload or create a batch file and pay many people in one go.

- They can set up future-dated or recurring payments, so salaries or rent go out automatically on time.

- Vendors and payees can be saved, so details do not need to be entered again and again.

- Card management (issue, freeze, limits, replacement requests)

- Users can request new business debit cards from within the app.

- If a card is lost or stolen, they can freeze or block it instantly without calling a branch.

- They can adjust spending limits, control where the card can be used, and order replacements when needed.

- Statements and links to accounting tools

- The app lets businesses download account statements in formats they can share with accountants or upload to accounting systems.

- Some apps also connect directly with popular accounting or ERP tools, so transactions flow automatically.

- This reduces manual work and lowers the chance of mistakes in bookkeeping.

Cost to Develop a Digital Banking App Like Mashreq NEOBiz in UAE

Different industry sources place digital banking app builds for UAE between $50,000 and $300,000+ for a simple-to-moderate scope and into the high six-figure range for complex, enterprise-grade products. For a NEOBiz-style SME product with strong security and compliance, a working planning range of $150,000–$600,000 is more realistic.

You can think about cost in four big buckets:

- Product and UX

- Engineering and integrations

- Security and compliance

- Launch and early maintenance

End-to-End Cost of Building an App like Mashreq

| Cost Area | Approx. Range (USD) | What It Covers |

|---|---|---|

| Product & Business Analysis | $15,000 – $40,000 | Requirements, use cases, regulatory mapping |

| UX / UI Design | $25,000 – $60,000 | Flows, screen design, prototypes |

| Backend & API Development | $60,000 – $200,000 | Core logic, integrations, services |

| Mobile Apps (iOS + Android) | $50,000 – $180,000 | App builds, testing, store releases |

| Security & Compliance Readiness | $25,000 – $100,000 | Security controls, audit prep |

| Launch & Early Maintenance | $15,000 – $60,000 | Production support, fixes, minor features |

When a proposal comes back far below this range, there is usually a trade-off hiding somewhere. It might be security, documentation, or long-term support.

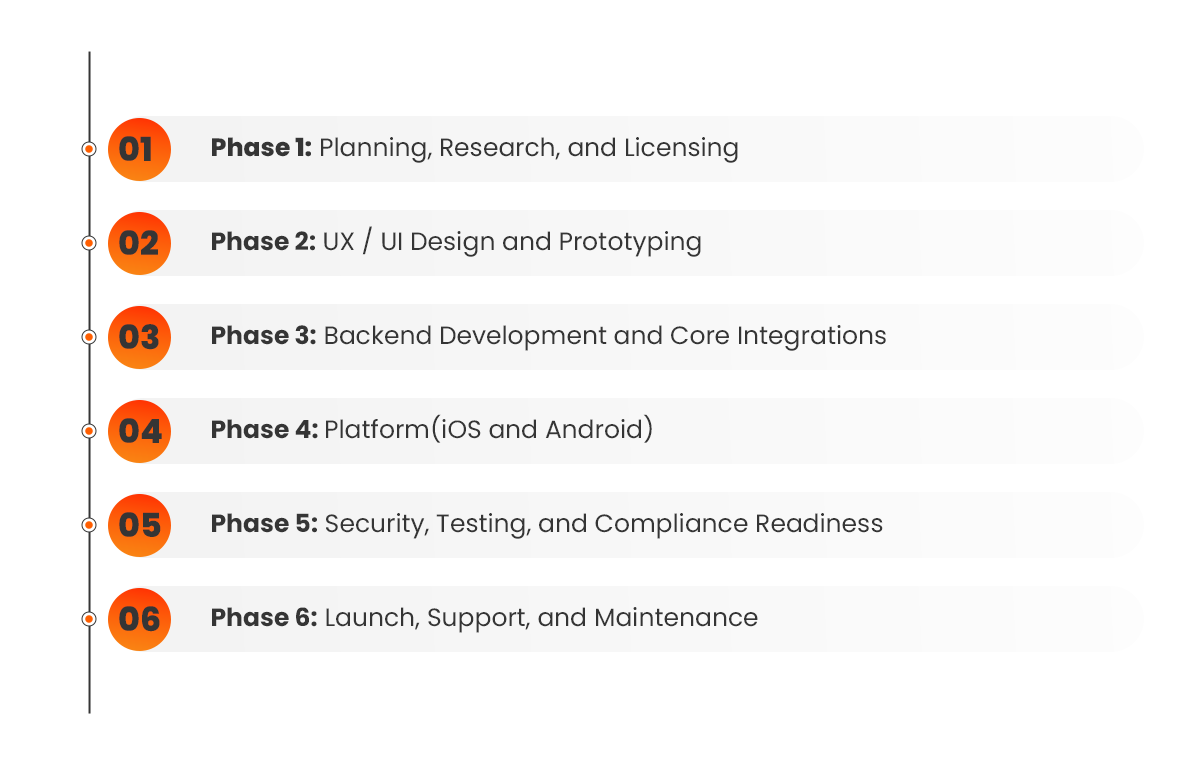

Phase-Wise Cost Breakdown

Breaking the journey into phases helps you manage both risk and decision-making.

You can approve budgets per milestone and adapt scope as you learn.

Phase 1: Planning, Research, and Licensing

This phase shapes your product vision and your regulatory path.

Key activities:

- Market and competitor research in GCC and global digital banking

- Clarifying audience segments (SMEs, startups, freelancers, etc.)

- Early conversations with regulators or advisors

- Drafting feature list and product roadmap

Indicative cost: $10,000 – $30,000, with licensing work sometimes budgeted separately.

| Phase 1 Item | Cost Range (USD) |

|---|---|

| Market & Competitor Research | $4,000 – $8,000 |

| Product Workshops & Roadmap | $4,000 – $12,000 |

| Licensing & Regulatory Scoping | $2,000 – $10,000 |

Phase 2: UX / UI Design and Prototyping

A smooth NEOBiz-style experience requires careful design across web and mobile.

Key activities:

- Defining user journeys for onboarding, KYC, payments, and support

- Designing wireframes and interactive prototypes

- Creating high-fidelity screens and a design system

- Running usability tests and refining flows

Indicative cost: $20,000 – $50,000, depending on the number of journeys and platforms.

| Phase 2 Item | Cost Range (USD) |

|---|---|

| User Flows & Wireframes | $8,000 – $18,000 |

| UI Design (Mobile + Web) | $10,000 – $28,000 |

| Prototyping & User Testing | $2,000 – $8,000 |

Phase 3: Backend Development and Core Integrations

This phase carries a large share of the technical effort and the cost.

Key activities:

- Building account, transaction, and payment services

- Handling roles and permissions, activity logs, and audit trails

- Integrating with core banking, payment gateways, and card processors

- Setting up databases, caching, and monitoring foundations

Indicative cost: $60,000 – $200,000, depending on the size of the feature set and integration complexity.

| Phase 3 Item | Cost Range (USD) |

|---|---|

| Core Backend Services | $30,000 – $100,000 |

| Core Banking & Payment Integration | $20,000 – $70,000 |

| KYC / AML Provider Integration | $10,000 – $30,000 |

Phase 4: Platform (iOS and Android)

This is where your users interact with the banking experience daily.

Key activities:

- Building native or cross-platform apps

- Connecting all app screens to backend APIs

- Implementing push notifications and secure session handling

- Handling edge cases such as poor connectivity and errors

Indicative cost: $50,000 – $180,000 for both platforms, depending on approach and depth.

| Phase 4 Item | Cost Range (USD) |

|---|---|

| iOS App Development | $25,000 – $90,000 |

| Android Development | $25,000 – $90,000 |

Phase 5: Security, Testing, and Compliance Readiness

For banking, this phase is not optional.

It is where you reduce risk and protect your license.

Key activities:

- Functional, regression, and integration testing

- Performance and load testing to simulate real traffic

- Security testing and penetration testing

- Preparing documentation and evidence for regulatory or internal review

Indicative cost: $25,000 – $100,000+, with higher spend for deeper security and audits.

| Phase 5 Item | Cost Range (USD) |

|---|---|

| Functional & Regression QA | $8,000 – $25,000 |

| Load & Performance Testing | $5,000 – $20,000 |

| Security & Pen Testing | $10,000 – $40,000 |

| Compliance Documentation | $2,000 – $15,000 |

Phase 6: Launch, Support, and Maintenance

After launch, you still spend money to keep the app stable and compliant.

Key activities:

- Deployment to production, app stores, and monitoring tools

- Early-stage incident response and bug fixing

- Minor improvements driven by early user feedback

- Ongoing patches, OS updates, and infrastructure tuning

Indicative cost: $10,000 – $50,000 for initial launch and the first few months, plus recurring yearly spend.

| Phase 6 Item | Cost Range (USD) |

|---|---|

| Go-Live & Rollout | $5,000 – $20,000 |

| Post-Launch Support | $5,000 – $30,000 |

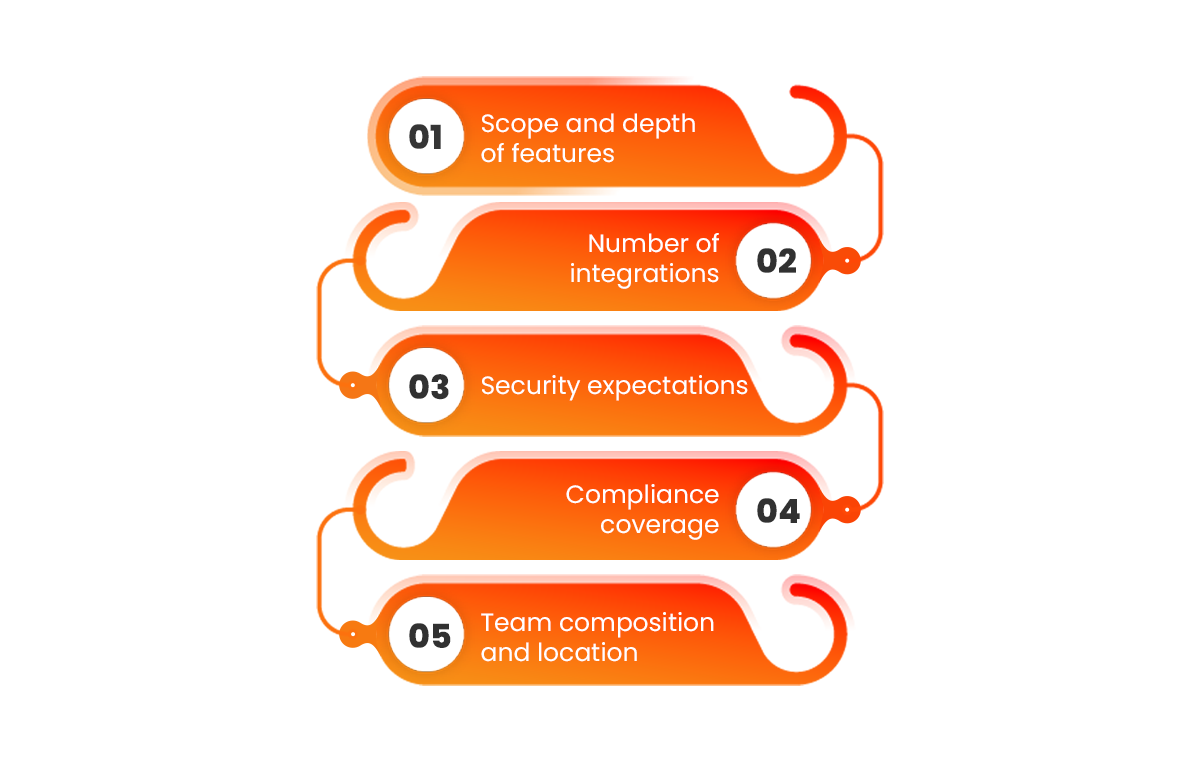

Factors That Affect the Development Cost

Several key factors determine how much your digital banking app will cost. Understanding these can help you anticipate budget ranges and plan effectively.

1. Scope and Depth of Features

This is about how much your app can actually do:

- Basic apps: view balance, check transactions, make simple transfers.

- Advanced SME finance apps: invoicing, approvals, payroll, expense tracking, advanced reports, tax or cash-flow tools.

- Every extra feature increases screens, logic, testing, and support.

Moving from a “view balance and pay bills” app to a “full finance hub for SMEs” significantly increases design work, development time, and QA effort. That’s why apps with similar labels can have very different cost ranges.

2. Number of Integrations

Integrations are every system your app needs to communicate with:

- Core banking system

- Payment gateways and card processors

- KYC / AML providers

- Accounting, ERP, or invoicing tools

- Analytics, messaging, and notification services

Each integration requires planning, data mapping, development, and testing. Any changes on the partner side (API versions, fields, rules) require updates and retesting. More integrations increase both initial build costs and long-term maintenance costs.

3. Security Expectations

Banking apps must treat security as a core feature:

- Strong login and multi-factor authentication

- Encryption for data in transit and at rest

- Fraud rules, alerts, and monitoring

- Role-based access control

- Proper logging for audits

Basic security is cheaper but may not satisfy regulators or your risk team. Advanced fraud detection, device checks, or monitoring increase development effort and tools, which directly impacts your budget.

4. Compliance Coverage

Compliance depends on where you operate and what services you provide:

- Single-country apps with simple products are cheaper.

- Multi-country apps or apps offering credit, cards, or cross-border services require more rules, reporting, and approvals.

- Your flows, data model, and reporting must support local regulations.

Broader compliance coverage adds legal work, edge-case handling, and technical complexity, which all increase costs.

5. Team Composition and Location

Who builds your app and where they are based affects total cost:

- Senior engineers in high-cost regions (USA, UK, UAE) charge higher rates.

- Teams in India or other lower-cost regions charge less for similar work.

- A senior team can work faster and reduce errors, but daily rates are higher.

- Cheap, inexperienced teams may need more time and rework, offsetting initial savings.

| Factor | Impact on Cost |

|---|---|

| Feature Complexity | Medium to Very High |

| Integrations Count | Medium to Very High |

| Security and Risk Controls | High |

| Compliance Reach | High |

| Team Location & Seniority | Medium to High |

Hidden Costs You Need on Your Radar

Many teams budget for “development” and underestimate the extras that follow. These hidden costs can have a significant impact on your overall budget.

- KYC / AML and fraud tools: Vendors often charge setup fees and per‑check or per‑transaction costs.

- Legal and compliance consulting: Planning and documenting your approach for UAE rules adds advisory time and fees.

- Security certifications or audits: External assessments, especially for payments, can add a separate line item.

- Cloud infrastructure: High-availability environments, backups, and monitoring tools require ongoing spend, not just a one-time fee.

- Ongoing maintenance: Many guides suggest planning around 5–20% of initial build cost annually, sometimes more for complex apps.

| Hidden Cost Category | Example Annual / One-Time Range (USD) |

|---|---|

| KYC / AML Vendor Fees | $10,000 – $70,000+ |

| Legal & Compliance Advisory | $10,000 – $50,000 |

| Security Audits / Certs | $10,000 – $40,000+ |

| Cloud & DevOps | $12,000 – $60,000+ |

| Maintenance & Updates | 5–20% of initial build |

These numbers rarely appear in that first “ballpark” quote, but they still impact your P&L and should be considered during planning.

Ready to Build Your React Native App?

Let’s turn your idea into a robust, cross‑platform app — estimate your cost, timeline, and features with our expert team at Zenesys.

Get a Free ConsultationLocation-Wise Cost Comparison: UAE vs India vs USA vs UK

Location does not just influence culture and time zones. It directly sets hourly rates and total budget for your project.

Typical Hourly Rates by Region

| Country / Region | Approx. Hourly Rate (USD) |

|---|---|

| UAE | $40 – $120 |

| India | $20 – $50 |

| USA | $80 – $200+ |

| UK | $60 – $160 |

How This Translates to a NEOBiz-Style Project

The choice of team composition impacts the overall project cost significantly:

- A US-heavy team can easily push the total towards the high end of the $300,000–$600,000+ band.

- A UAE-led, India-built hybrid can often deliver a strong product in the $150,000–$350,000 range, depending on scope.

- A UK-centric delivery model tends to sit between UAE and US in overall cost.

| Model Type | Typical Budget Range (USD) |

|---|---|

| Mostly UAE / GCC Team | $200,000 – $500,000+ |

| Hybrid (UAE Product + India Delivery) | $150,000 – $350,000 |

| Mostly USA / UK Team | $300,000 – $600,000+ |

How to Minimize Development Cost Without Cutting the Wrong Corners

Practical Ways to Keep the Budget in Check. Cost control in banking is about priorities, not shortcuts. Here are some practical ways to manage your project budget effectively:

- Start with a focused MVP: Launch with core flows such as onboarding, account view, transfers, and basic card management, leaving advanced features for later sprints.

- Re‑use battle‑tested components: Instead of building everything from scratch, use trusted vendors for KYC, AML, notifications, and analytics.

- Adopt a hybrid team setup: Keep product, compliance, and key decisions close to the UAE market while using cost-effective engineering talent from India or similar locations.

- Phase your releases: Start with one customer segment or one geography first, then roll out more features or regions after proving product-market fit.

| Cost Control Lever | Budget Impact |

|---|---|

| Focused MVP Scope | High |

| Component Reuse | Medium to High |

| Hybrid Team Model | High |

| Phased Rollout | Medium |

How to Build an App That Surpasses Competitors Like NEOBiz

If you want to compete with NEOBiz, copying feature checklists is not enough. You need to outperform on specific points that matter to SME users.

Areas Where You Can Outperform

- Onboarding experience: Fewer clicks, clearer document guidance, real-time status updates, and honest communication about approval timelines.

- Cash flow intelligence: Easier ways to see who owes what, upcoming debits, and projected balances.

- Support quality: Fast human assistance for edge cases, supported by good self-service for everyday issues.

- Partner integrations: Tight integration with accounting, invoicing, and payroll tools your customers already use.

| Differentiation Area | Sample Focus |

|---|---|

| Onboarding | Real-time checks, transparent progress |

| Insight & Analytics | Visual cash flow, trends, upcoming obligations |

| Support | In-app chat, call-back, guided help |

| Ecosystem | Accounting and payroll connectors |

When your app actually saves time, reduces stress, and clarifies money, you create a strong reason for SMEs to switch.

AI Features in a Modern Digital Banking App

AI in banking is moving from “nice marketing line” to practical toolset. The trick is to choose use cases that directly support risk control or customer value.

High-Impact AI Use Cases

- Document and ID verification: AI can help validate IDs, detect anomalies, and reduce manual review load during onboarding.

- Fraud detection: Models can scan patterns across transactions to flag unusual behavior before losses grow.

- Cash flow insights and nudges: Smart suggestions about upcoming bills, low balance risk, or irregular expenses make the app more useful for SMEs.

- AI support assistants: Chatbots can handle routine questions instantly and hand over to human agents for complex situations.

| AI Feature Area | Cost Impact | Example Benefit |

|---|---|---|

| Document Verification | Medium | Faster KYC and lower manual review load |

| Fraud Detection | High | Reduced financial loss and stronger trust |

| Cash Flow Insights | Medium | Better financial control for SME customers |

| AI Support Chatbot | Medium | Faster responses and lower support workload |

Used well, AI can justify a higher development budget by improving retention and lowering risk.

Want to Bring AI to Your App?

Implement AI features like smart chatbots, fraud detection, and cash flow insights to make your app smarter and more valuable.

Connect with Us TodayStep-by-Step Guide: How to Build a Digital Banking App Like NEOBiz

This section gives you a clear, practical path to build a digital banking app for SMEs and similar users.

Step 1: Define Business Goals and Target Segment

- Decide who you are serving first: SMEs in one sector, startups, freelancers, or a mix.

- List your primary business outcomes such as new account growth, deposit volume, or fee income.

Step 2: Map Regulations and Risk Requirements

- Work with legal or compliance advisors familiar with UAE Central Bank and related regulations.

- Turn those requirements into concrete constraints on data handling, onboarding, and reporting.

Step 3: Design User Journeys and Interfaces

- Create detailed flows for key actions: onboarding, identity checks, account viewing, payments, card management, and support.

- Translate these into wireframes and then into clickable designs that can be tested with real users.

Step 4: Choose Tech Stack and Delivery Model

- Pick your backend technology, database, and hosting approach with security and scalability in mind.

- Decide whether you will build native apps, cross-platform apps, or both, and confirm how you will split work across locations.

Step 5: Build Backend and Integrations

- Develop the core banking logic, APIs, and integration points for your vendors.

- Set up monitoring from day one so you can track errors, performance metrics, and suspicious activity.

Step 6: Build and Connect Mobile Apps

- Implement all necessary mobile features and connect them to your backend services.

- Test for error states, weak network conditions, and edge cases to avoid “stuck” experiences.

Step 7: Add Security, Testing, and AI Enhancements

- Run functional, integration, performance, and security tests.

- Add AI use cases where they are clearly tied to risk reduction or customer value.

Step 8: Go Live, Monitor, and Iterate

- Launch with a controlled audience or in phases.

- Watch user behavior, fix issues quickly, and plan continuous releases instead of one massive launch followed by silence.

How Zenesys Solutions Inc Can Help you

Zenesys Solutions Inc can act as a partner across this full journey instead of handling just one slice. That matters when you need coordination between product, engineering, and compliance.

What a Partner Like Zenesys Brings

- Product and UX thinking aligned with SME behavior and UAE market expectations.

- Engineering teams that can handle secure backend systems, mobile apps, and third-party integrations.

- AI and analytics expertise to embed features such as fraud checks or smart cash flow views in a way that supports business performance.

- Ongoing support models that cover updates, performance monitoring, and incremental feature work.

| Area of Support | Example Outcomes |

|---|---|

| Product & UX | Clear flows, higher adoption |

| Engineering Delivery | Stable, scalable, secure implementation |

| Data & AI | Better decisions and risk control |

| Support & Maintenance | Fewer outages and smoother improvements |

Frequently Asked Questions

Q1. What is a realistic budget for a NEOBiz‑style app in UAE?

A realistic budget for a serious, compliant SME digital banking app in the UAE is $150,000–$600,000, depending on complexity, number of integrations, and team structure.

Q2. How long does such a project usually take?

Most sources and real‑world programs suggest 9–18 months from discovery to production launch for a full digital banking app, including design, build, testing, and compliance checks.

Q3. Is it cheaper to build in India and serve UAE customers?

Development rates in India are lower than in the UAE, USA, or UK, so many teams use a hybrid approach where engineering is based in India but product and compliance leadership remain aligned with the UAE market.

Q4. How much should I plan annually for maintenance?

Guides for fintech and banking apps suggest 5–20% of your initial development cost per year for maintenance, updates, and infrastructure, with higher percentages for complex platforms.

Q5. Do I need AI in the first version?

AI is helpful but not mandatory in version one. Most teams focus first on reliable onboarding, strong security, and smooth payments, then add AI features like fraud detection or smart insights when usage data starts to build.

.webp?lang=en-US&ext=.webp)

.webp?lang=en-US&ext=.webp)